The real estate financing sector in Austria is growing year to year. Investors leverage capital from outside sources to purchase or renovate property. Real estate financing comprises either residential or commercial real estate financing and is the most commonly used system for investing in real estate.[1]

Austria's private banks are managing substantial amounts of assets for their private clients. However, private clients often turn to different banks when it comes to real estate financing and are not sufficiently serviced by their private “house” banks.

Market analysis and expert’s outlook

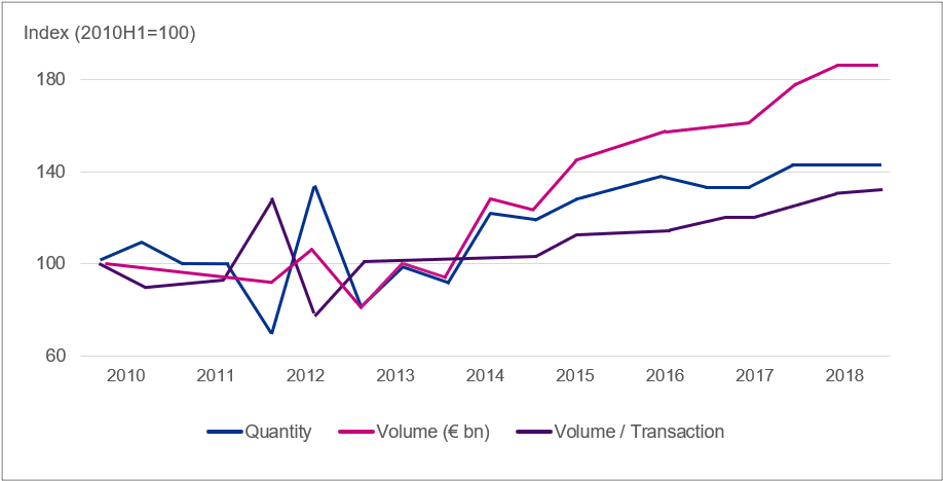

The Austrian real estate market has been buoyant since the mid-2000s. As shown in figure 1, real estate transactions have risen consistently in recent years due to an excess demand on the Austrian real estate market.[2] In addition to that, real estate price growth in Austria, especially in Vienna, was significant. Indeed, real estate prices have increased by +5.2% in 2020 compared to the previous year.[3] This price growth was primarily caused by demographic developments as well as a strong growth of residential construction.[4]

Figure 1 Development of real estate transactions in Austria since 2010 (Source: OeNB, Immobilien aktuell-Österreich Q4/19, 2019, p. 7).

Figure 1 Development of real estate transactions in Austria since 2010 (Source: OeNB, Immobilien aktuell-Österreich Q4/19, 2019, p. 7).

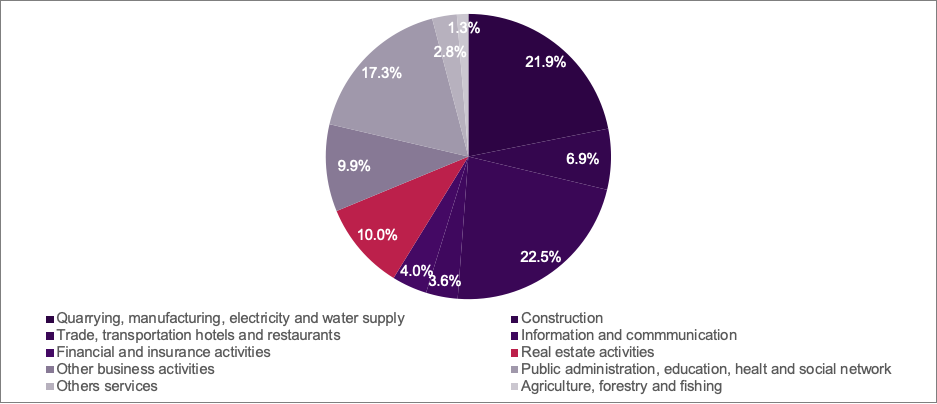

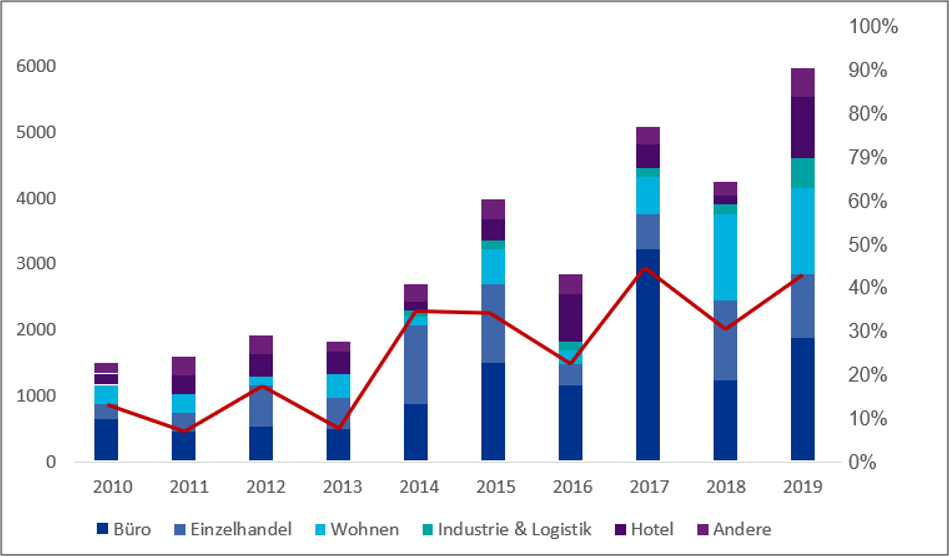

The relative importance of the real estate sector within Austria is evident: By 2019 real estate activities contributed 10% of the total gross value added in Austria.[5] 2019 has been the new record year in terms of real estate investments. More than € 5.9 billion have been invested in real estate assets, 17% more than in 2017. The two strongest asset classes are office and residential investments. There were also high activities in retail, industry & logistics as well as hotels.[6]

Figure 2 Gross Value added in Austria in 2019, % of gross value added at current prices (Source: OeNB, Facts on Austria and Its Banks, March 2020, page 9).

Figure 2 Gross Value added in Austria in 2019, % of gross value added at current prices (Source: OeNB, Facts on Austria and Its Banks, March 2020, page 9).

Figure 3 Investment Volume Austria by type of use and share of transactions (CBRE, Real Estate Market Outlook Österreich, 2020, p. 10).

Figure 3 Investment Volume Austria by type of use and share of transactions (CBRE, Real Estate Market Outlook Österreich, 2020, p. 10).

Bank lending to nonfinancial corporations has been accelerating in Austria since mid-2017. In 2019, corporate lending grew by 6.2% year on year, and lending to households by 4.2%. The key growth drivers were loans to real estate-relating sectors and mortgage loans to households.[7]

Nevertheless, most private banks do not deal with real estate for their customers or do so only rudimentarily. This is because banks are worried about the considerable outflow of assets when investments in real estates are arranged.[8] However, these concerns seem unexplained when taking into account the earnings potential - as exposing mortgage loans. Especially under consideration of the asset diversification of Austrian private wealth clients with a strong focus on real estate, there is an untapped potential for private banks. Indeed, a large part of the assets of private wealth clients now consists of real estate. In recent years, the demand for financing and real estate has accounted for an increasingly large share of the total earnings potential in the private wealth business with high net worth individuals.[9]

Financial market experts believe that traditional active investments will continue to be the core of the financial industry, but alternative investments, such as real estate investments, will grow considerably faster.[10] Consequently, we see further potential in the combination of private wealth services and real estate financing.

Challenges ahead

Systematic risks arising from residential housing financing have remained limited in Austria. To ensure that this will remain the case, sustainable lending standards are essential. Consistent compliance with supervisory expectations will be crucial for safeguarding financial stability in Austria and will have a lasting impact on developments in the real estate financing sector. Other than that, Austria’s real estate market is to expect turbulent times due to the impact of Covid-19. Although Austria emerged as a preferred investment location and better positioned itself compared to other European countries, the global health crisis will affect real estate prices and transaction volumes in Austria in short-, medium-, and long term.[11]

Strategic positioning – combination of private wealth services and real estate financing

Private banking offers investment-based advice to clients and addresses the individual needs of each investor. Wealth management is the management of portfolios in order to achieve a range of different goals including investment-based growth, transferring assets and sometimes philanthropic endeavors. Private and wealth management services include asset allocation and structuring, tax planning, estate planning, philanthropy, family arbitrage, as well as the relocation of families and their associated businesses. While investments in real estate – directly or indirectly via securities - are often on the service agenda, financing (including mortgage lending) is rarely seen as a combined service offering. Many private wealth banks are rather reluctant regarding the actual process of real estate and mortgage lending. Consequently, most asset managers on the Austrian private banking market remain in loan business.

As indicated above, we believe that real estate services are an important investment field for private clients. Private banks need to adapt their service offering in view of the customer’s needs. In fact, a wholistic approach that considers all service demands of its clients – in particular real estate - appears to be an unexploited opportunity. Rather than focusing exclusively on the assets managed by the private bank, the bank should also examine the client's general asset situation, including real estate assets and the client’s banking relationships with other credit institutions. A wholistic approach that takes into consideration all asset classes will yield greater benefits not only to the client himself, but also to the private bank offering optimized services.

The combination of private wealth services with financing of real estate and mortgages could be one of the most promising growth areas for private banks in the future.

XING Profile

Facebook

LinkedIn

www.igor-strehl.com/

dunaj-consulting.com/igor-strehl

www.fameinvestments.at/

Igor has many years of experience in the financial sector with a proven track record of investment activity with a main focus on M&A transactions. He has acquired the skills necessary to increase and retain profits whilst stably managing assets. His capabilities have been tested and proven during times of economic crisis, and he is critically poised to react to new trends. He has also gained experience whilst working for various financial institutions. Since 2017, Igor has been holding executive and board member functions in various entities as well as performing investment activity (with a main focus on M&A transactions) and management consulting services.

[1] https://www.lexisnexis.com/uk/lexispsl/bankingandfinance/document/391289/5CYK-0301-F185-X0HD-00000-00/Real-estate-finance_overview.

[2] OeNB, Immobilien aktuell-Österreich Q4/19, 2019, p. 6-7

[3] OeNB, Immobilien aktuell-Österreich Q3/20, 2020, p. 5

[4] OeNB, Facts on Austria and Its Banks, March 2020, pages 10

[5] OeNB, Facts on Austria and Its Banks, March 2020, pages 9

[6] CBRE, Real Estate Market Outlook Österreich, 2020, p. 10

[7] OeNB, Facts on Austria and Its Banks, March 2020, pages 6, 7

[8] Gramann (2017), p. 28.

[9] https://bankinghub.de/banking/research-markets/private-banking-oesterreich-2018

[10] HSBC, The Rise of Alternatives, 2017, p. 4.

[11] CBRE, Immobilienmarkt Österreich – Mid Year Review H1 2020, 2020